Annual Contribution Statements

The Annual IRS Contribution Statements are available below to download, customize and print for your church administrative office...

Does the Internal Revenue Service (IRS) require these statements every year?

According to the IRS Pub 1771:

The donor is responsible for obtaining a written acknowledgment from a charity organization for any single donation of $250.00 or more before the donor can claim a charitable donation on his or her federal income tax return.

However, the IRS does require you as a charity organization to provide a written disclosure to a donor who receives goods or services in exchange for a single payment in excess of $75. You can click on the link above to access and download the complete IRS publication on this subject matter.

So it is up to your church policy if you send out these statements or if you make them readily available for anyone who requests one.

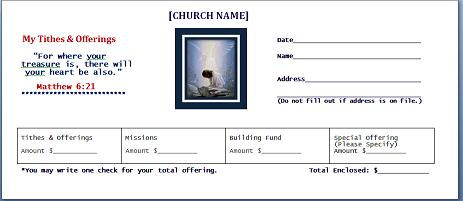

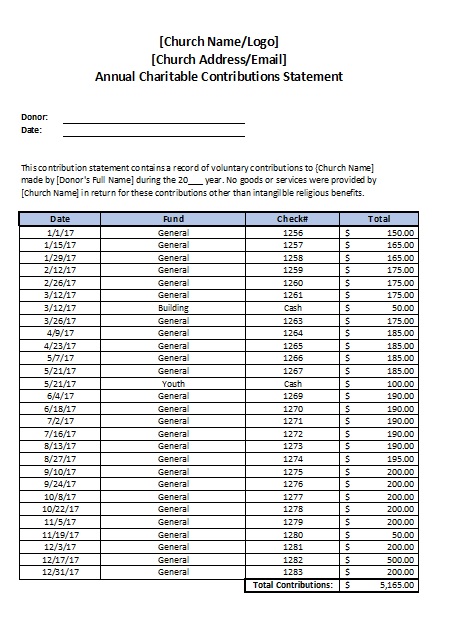

The itemized statement for your member's donations should include the following:

- Church Name or Logo (Church Address and Tax ID Number is optional but I did add it to the form below as many churches do include this on the statement.)

- Title of Report or Statement

- Donor's Name(s)

- Donor's Address

- Listing of Each Donation (Include Date of Donation, Description (Tithes, Offering...), Amount, Check Number (if applicable) and Fund (General, Missions, Building...) and more if you like.)

- Total Contributions for the Year

- Authorized Signature (Church Secretary, Church Treasurer, Pastor...)

This statement can be inserted into your letter for donations if you are attaching the statement:

- Attached [or “Here” if it is a short list… just list below you letter] is an itemized statement of your donations for [year], according to our records. If you have any concerns about the accuracy of this information, please let us know.

The deadline for issuing these receipts or statements to your donors is January 31st or at the very latest before they do their tax return. Your donation receipts or letters can be issued gift-by-gift, monthly, quarterly, annually or any other frequency just depends on what your church wants to do. However, always record this frequency in your church policy and procedure manual.

Shepherdbase has the Annual IRS Statements available with the click of a button and it's an affordable way for your church to track church member's information (name, address, phone...), contributions, attendance and much more!

Click here to get more information on how Shepherdbase can meet these needs and much more!

If you want this Annual Charitable Donation Statement (picture above) in MS Excel format that will automatically calculate the contribution totals, you will have to purchase the Church Forms CD which has all the forms...on FreeChurchForms.com in editable formats (MS Excel and/or MS Word).

Click here for more information on the affordable Church Forms CD!

Click on the link(s) below to download the statement(s)for your members or donors:Annual IRS Contribution Statement

You can get Adobe Reader free here (a new window will open so you can download it without leaving this page).

If you want to open the file in your browser window, just click on one of the links above. However, if you want to download the file to view later, then right-click on the link and choose "Save Target As" or "Save File As". Then select where you want to save the file on your hard drive.

If you would like to receive access to the FreeChurchForms.com Table of Contents that has all the free church forms, certificates, flyers, brochures, letters, games and more that are listed in alphabetical order by category with links leading to the page to immediately download just simply sign up for my free monthly newsletter below. You will also receive access to my free 14 Page eBook - "Top Ten Tips on How to Organize Your Office" as a Thank You Gift for signing up. Enjoy! :)

Note: These sample forms are meant to serve as example forms and should not be construed as legal documents. Please contact a legal professional for legal language for your specific organization.

Free eBook - "Top 10 Tips on How to Organize Your Office"

when you...

Subscribe to "The Form Gallery"

FreeChurchForms.com Monthly Newsletter (Free)

**The information above will be secure and your privacy will be maintained.** Click here to read and accept the FreeChurchForms.com Privacy Policy (GDPR Update).

Please feel free to contact me if you have any questions.

Return to Annual Contribution Letters from the Annual IRS Statement.

Home | FCF Blog | Contact | About | Terms of Use

Collection of all the Church Forms, Flyers, Certificates...(1,000+) on FreeChurchForms.com available on CD or Instant Download - each form available in Microsoft Office Word editable format. Plus 5 Free Bonuses!

The Church Forms CD is Convenient and Saves Time

Need an Affordable, User Friendly Church Membership Database? Shepherdbase Could Be Just What You Have Been Looking For...Available on CD or Instant Download.

- User Friendly

- Tracks Memberships, Contributions, Attendance, Etc.

- Instant Access to Church Directory, Contributions, Attendance, Etc.

Need an Affordable, User Friendly Event/Sermon Tracking Database? Pastoral Recordbase Could Be Just What You Have Been Looking For. Available on CD or Instant Download.

- User Friendly

- Tracks Events (Baptisms, funerals, etc.)

- Tracks Sermons (Pastor's or minister's sermons)

- Tracks Phone Numbers (Pastor's phone book)

- Tracks Church Info (Name, address, etc.)

Special Offer!

(Shepherdbase CD & Church Forms CD with 1,000+ forms, flyers...along with Free Bonuses) - Also Instant Download Available!

(Shepherdbase CD, Church Forms CD with 1,000+ forms... & Pastoral Recordbase CD along with Free Bonuses) - Also Instant Download Available!

Church Offering Envelope Templates

Very easy to download, modify and print on your blank envelopes.

All-In-One

Powerful Church Software

Are you tired of trying to manage your church from several different systems and spreadsheets?

You need Aplos.

Cloud-based software to handle your accounting, people, and giving from one platform.

Church Finances Accounting Book

Are you stressed about your church accounting? If yes, then you need this accounting book!

Visitor Testimonials

*Disclaimer

*Terressa! I received the discs today!! A few years back I was at a small church that used your software and it was perfect for their volunteers to use. The church I am at now has 2 volunteer secretaries and one found your product and I gushed!!! Her first request is a directory so this will be perfect. God Bless you for creating such a great system (Shepherdbase). Regards - Tonya - OK - U.S.

*Disclaimer

*This is the 1st time I've visited your website and I just wanted to say "thank you". I go to a very small Christian Church and thanks to you, the forms you have for a children's ministry will keep me from having to "reinvent the wheel" and I am very grateful to you. We are a very small church (about 40 regular attendees) and 90% of those are over 65. We just had a young couple offer to help us get a Youth Group. Thanks to you, we won't have to do to much to get this off and running for the holiday season. Thanks again! - Kentucky - U.S.

*Disclaimer

*I do the tithes at the end of the year for a very small outreach in the city of Detroit. They had been paying thousands of dollars every several years trying to keep a database of their donors.

I searched last year for something less costly for them and came across your database (Shepherdbase). It is a blessing and so appreciated. Thank you for all your hard work and thank you for Giving To The Lord. Peacemakers Int. in Detroit on Chene street is another ministry you have blessed. - Charlene - U.S. *Disclaimer

*This website has been very useful for my ministries with Hospice, the Hospital and Human Services. I recommend this website to any church, ministry or agency that is supporting or ministering to people. God Bless You - Chaplain Dave - U.S. *Disclaimer

*Just wanted to let you know how helpful your resources are. We are a small church and have missed out on doing a lot of things. We ordered your Church Forms on CD and are just pleased. Keep up the good work of providing resources for Churches. - Lillian - U.S. *Disclaimer

*I am a minister of the Gospel of our Lord and Savior Jesus Christ and have been tremendously blessed to access you and pray that God the Almighty favor you in what you do. You have enabled me to access ready-designed church documents. Thanks and God Bless You Terressa. - Bro. Mike - Kenya, Africa *Disclaimer

*Thank You! You're heart for giving free resources and making things so affordable is truly a blessing. My Pastor always says: "What you make happen for someone else, God will make happen for you!" May God richly bless you and your ministry to us and so many others, enlarge your territory and bring financial blessings with good measure, pressed down, shaken together and running over!!! 10,000 Blessings! Leeanna - U.S. *Disclaimer

*Thanks for making this site available. I took over as secretary of our small church a few months ago, and I am having to create a lot of forms. This site is a blessing! - Vicki - U.S. *Disclaimer

*After years of frustration and being overcharged for Church Management software, I came across "Shepherbase" and all my problems were solved. *Disclaimer

This database:

- 1. Tracks members and visitors

- 2. Tracks contributions

- 3. Organizes by both individual AND family

- 4. Creates professional letters, relevant to church ministry

- 5. Is easy to use

- 6. Costs a mere fraction of other databases offering similar features. *Disclaimer

- 7. So much more.

I am very thankful for this product and I recommend it to anybody wanting to exit the cost and complexity rat race of Church databases.

Thank you Shepherdbase!

Brandt *Disclaimer

Anchorage, Alaska

Does your church use QuickBooks? If yes, then the "QuickBooks for Churches and Other Religious Organizations" by Lisa London, CPA eBook below is a must for you!

Lisa will

walk you through QuickBooks from start to finish, complete with

examples, terminology, and everything a busy church administrator or

bookkeeper needs to know. For more information just click the link above!

Check out FreeChurchForms.com on Your Mobile!